Cut the keg tax

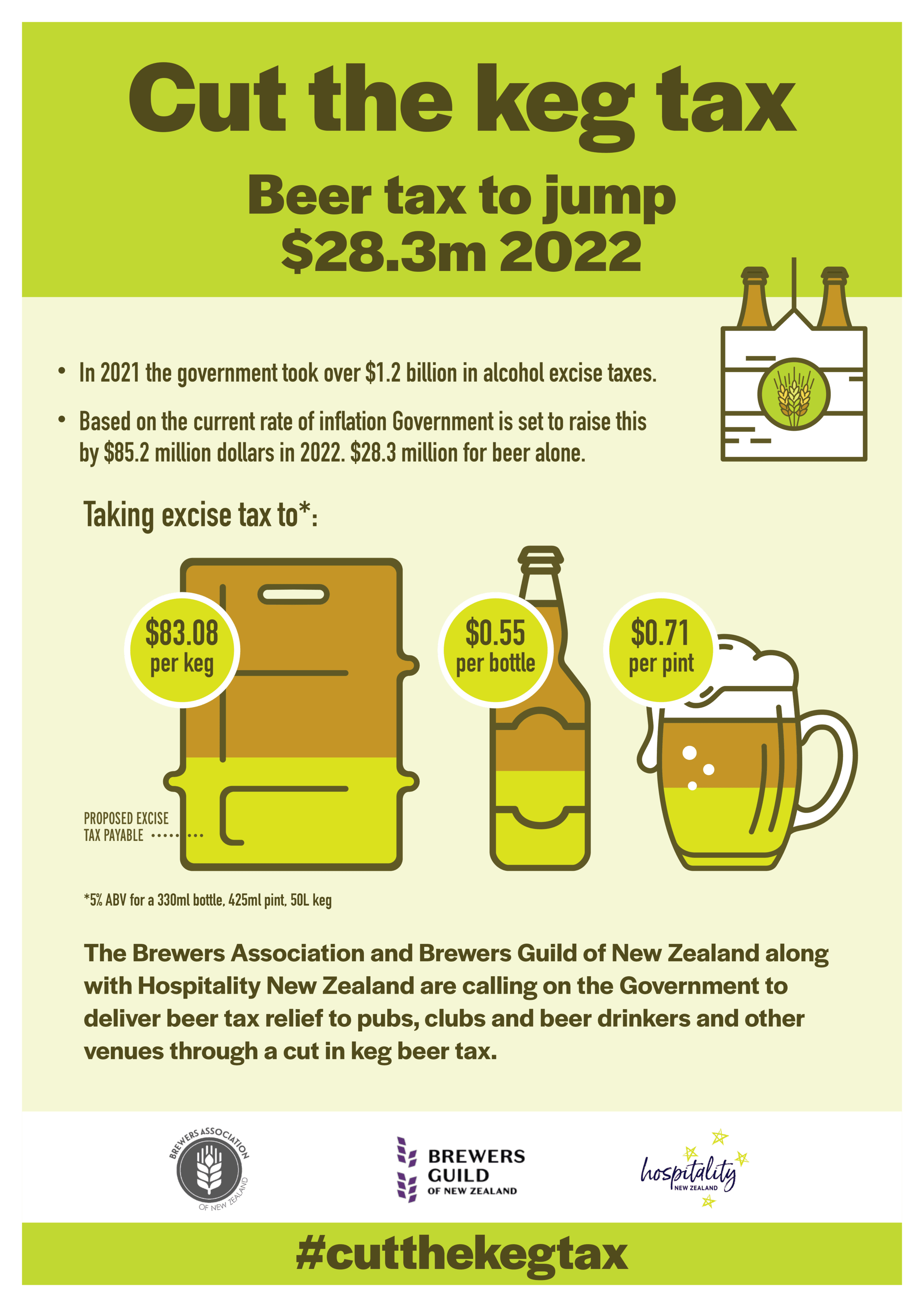

Beer tax to jump $28.3m in 2022

The Brewers Association and Brewers Guild of New Zealand, along with Hospitality New Zealand are calling on the Government to deliver beer tax relief to brewers, pubs, clubs, other venues, and beer drinkers through a cut in kegged beer tax.

In 2021 the government took over $1.2 billion in alcohol excise taxes.

Based on the current rate of inflation, the Government is set to raise this by $85.2 million dollars in 2022.

This includes a $28.3 million increase for beer alone*.

WHAT THESE TAX INCREASES WILL MEAN TO YOU:

*5% ABV for 330ml bottle, 425ml pint, 50L keg

WHAT YOU CAN DO TO HELP

OUR BEER TAX RELIEF

Policy Proposal

50% keg tax reduction

= $41.17 saved per 50 litre 5% ABV keg per litre of pure alcohol

- We are asking for the keg beer rate to be reduced by 50 per cent to provide relief for pubs, clubs, and beer drinkers.

- This would be a one-off decrease with the rate then increasing in line with CPI annually following the reduction. The change would not impact the rates for pack beer.

- A 50% reduction in the keg beer tax would mean the rate would drop from $31.089 per litre of pure alcohol to $15.5445 per litre of pure alcohol for full strength draught beer.

Support for the hospitality sector

Over 160,000 New Zealanders are employed in the accommodation and food service industry, many of these being pubs and restaurants. With venues seeing huge decreases in trade since the COVID-19 outbreak, a 50 per cent keg beer would reduce the tax payable on a pint of beer by around 35 cents.

The next beer excise increase will be on 1st July and is likely to be the biggest hike in over three decades - just as venues start to recover.

Beer sales are critical for pubs and clubs, representing about 70% of all their alcohol sales.

HELP US CUT THE KEG TAX

➀

Add your name to the petition by filling in the contact form below

➁

Email your local MP (contact list here)

➂

Follow the campaign on social media at #cutthekegtax

➃

Download and share the official campaign images